Pro

-

Pro Digital Carbon Smart Silicone handlebar tape review

Handlebar tape review: Pro Digital Carbon Smart Silicone £16.99

By Henry Robertshaw Published

-

Pro Star Series Cavendish bar and stem review

Pro Star Series Cavendish bar and stem - Unique bar set-up built for sprint king Mark Cavendish, £74.99, £149.99

By Mike Hawkins Published

-

PRO Endure NPU overshoes review

PRO Endure NPU overshoes

By Cycling Weekly Published

-

Pro UD Carbon cage review

Pro UD Carbon bottle cage £49.99

By Mike Hawkins Published

-

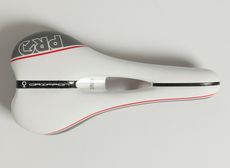

Pro Griffon Lady women's saddle review

The Pro Griffon Lady women's saddle has a rounded profile with a small cut-out for ventilation. It's comfortable padding comes into its own particularly for less even road surfaces.

By Cycling Weekly Published

-

Pro Ultimate gloves review

By Henry Robertshaw Published

-

Pro Minitool 11 multi-tool review

A small multi-tool that any jersey pocket will have space for, we tried out the Pro Minitool 11 multi-tool

By Cycling Weekly Published

-

Pro Team Compressor tubeless reservoir review

The Pro Team Compressor provides a robust, easy-to-use solution to seating tubeless tyres, which works with your current track pump, is effective and won’t break the bank.

By Paul Norman Published