Why do so many 2021 bikes cost upwards of £10,000?

Sure, you could buy a motorbike for that - but would it have a chassis made with 'unicorn hair'?

A raft of this year’s hottest launches contained a halo bike above £10,000. Price tags that were once considered belonging to the niche (often Italian) brands that sat in the garages of millionaires have now trickled down to the club run, leading to questions from some riders and outrage from others.

“Surely, you could buy a motorbike for that money?” has been a common theme.

For Specialized there was the £10,500 Tarmac S-Works SL7 and £10,750 S-Works Aethos, both of which had an extra £1,000 added to the price months later. For BMC it was the SLR01 One with SRAM Red AXS, at £10,250. Trek’s Emonda SLR09 sat just below the threshold at £9,700 whilst the Giant TCR SL Disc was released at £9,499 before jumping up to £9,699 soon after launch. Then, there was that €10,000 BMC Masterpiece frame.

The price hikes look to be above inflation and are focused on the upper ends of the range. A 2015 S-Works Tarmac SL5 Disc RRPed at £8,000 whilst the 2021 S-Works Tarmac SL7 sits at £11,500. Comparatively, a Shimano 105 specced Allez was £1,200 in 2015 whilst the 2021 model is £1,249. In all cases, of course, the bikes have seen change and development.

Is it all about 'unicorn hair'?

“Obviously, things like exchange rates and Brexit are going to affect price points,” explains Tim Allen, who builds bikes for customers at Soigneur London as well as having his own links in production. However, he reckons the price boost has more to do with material costs than shipping costs.

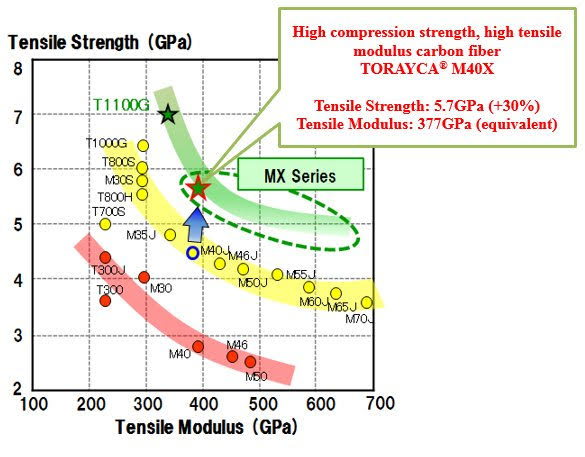

“Toray M40X, which was released in 2018, is the most obvious change [in the industry]," Allen explains – referring to the carbon produced by Japanese giants Toray Industries, which provides carbon for a high number of brands.

The latest race content, interviews, features, reviews and expert buying guides, direct to your inbox!

So far, only Canyon is open about its use of Toray M40X, which it refers to as the deliciously vague "unicorn hair" helping it to get the Ultimate CFR frame weight down to 641 grams. Other brands prefer to keep their recipes to themselves, but Toray provides carbon to a lot of major brands including Specialized.

The benefits of M40X – which is stronger and stiffer than alternatives – would be "wasted without the precision of laying the carbon in the frame," according to Allen, requiring "specialist teams, increased labour time, fewer frames produced, and additional and probably high-cost quality control such as CT/X-ray scans to check for voids or splits where carbon is meant to overlap within very small tolerances."

Founder and frame builder at Filament Bikes, Richard Craddock, has also heard tales of this new carbon: "I hear... that it's manufactured once a year to a total of two tonnes, supplied exclusively to Toray Industries Japan's own prepreg company where it's combined with a resin with nano additives. The super-expensive fibres have higher mechanical test numbers that allow a reduction in part weight. The engineer can retain riding performance while using less material. That's the only ride enhancement."

Use of this carbon, it seems, is not high on Craddock's agenda - the UK carbon specialist says he prefers to make frames with slightly thicker tube walls over super light chassis'.

"Laminates have to be thinner to reduce weight and that can make them less durable. The same part strength and stiffness can be achieved using more material of an intermediate modulus fibre with the upside of a thicker tube wall that's more durable. By durable, I mean resistant to damage from handling and minor crashes. But thicker laminates also require more hours of skilled labour," he says.

Asked for more info on this 'miracle carbon', even Canyon was cagey. It did tell me that the carbon is included in a number of models, including the Speedmax CFR, which is 200g lighter in its newest iteration, but the brand did add: "This is not all strictly to do with the use of different carbon."

Specialized told us: "We won’t have a specific menu of carbon ingredients. Although... Toray is, and has been for a long time, one of our CF suppliers."

Supply and Covid-19 demand

Of course, not everyone is using 'unicorn hair' and there are probably other factors involved in any price hikes.

“From my research, labour costs are going up in Asia,” Allen says. “When all the mainstream brands started shifting to production to Asia, a lot of that was down to costs, but now Asia owns the market,” he explains. So, capitalism has backfired? “They’re not using Asia because it’s the cheapest, but because those factories are the best – and now they’ve started increasing their prices,” he adds, noting that ideally, this will lead to greater Quality Control (QC) and more environmentally friendly methods, though that remains to be seen.

Craddock does offer some suggestion that more change could be due, stating: "There's a huge amount of skilled labour in making carbon frames. So if wages in Taiwan rise then bikes cost more. However, global demand for carbon fibre may weaken if aeroplane production slows. Aerospace is the largest buyer."

He also reckons a lot of price increases can be placed at the door of a supply and demand – put simply, cycling has been perhaps too popular for its own good in 2020.

"The lockdown in China and other countries interrupted the manufacture and movement of everything. Steel, chemicals, carbon fibre and finished components. Maybe purchasing managers also reduced or cancelled orders. Then we had good spring weather and furlough payments so people rode bikes and bought new ones. Demand was surprisingly strong and it drained the supply chain so companies competed for product and prices rose.

"While demand was strongest at entry-level there was also some effect at the top," he says, adding very tellingly, "but brands can't charge more than customers are willing to pay."

The Covid-19 effect on demand was the reason Specialized gave for its price hikes earlier in November. Asked why models such as the Tarmac and Aethos increased by as much as £1,000, the brand said: "The Covid-19 pandemic has truly sparked the cycling revolution. Whilst this is great for our sport, it has led to some challenges in meeting this increased demand. Our entire supply chain is facing unprecedented difficulties, leading to more complexity and increased costs. We are also investing heavily to increase production and maintain stability. This has led to adjustments to some prices as we set ourselves up to better meet the needs of more riders.”

As well as demanding more bikes, enthusiasts are also seeking greater performance from them. "Just considering the bikes themselves there's been a tech escalation. All top-end bikes are electronic and hydraulic now while maybe 10 years ago they had rim brakes and even some mechanical shifting," Craddock says. And that's true, gone are the days that club runs were accompanied by a theme tune of clunking gears. Now we just have to make do with pushing the bloke who forgot to charge his.

Why the price hike?

So – there we have it: supply and demand, the latter being for stiffer, stronger and lighter - and the increasing cost of the overseas workforce that has risen to take a crowing place in the industry.

Coming back to the automotive argument. Sure, I could buy a Honda CBR650R for £7,729 and still have change left over to buy leathers and a fancy helmet over buying an £11,000 bicycle. A few steps up the rungs I'd need £20,000 for something track-ready like a Honda Fireblade SP. It's important to remember that these top-flight bikes are the halos of the range, designed to win Tour de France stages and Olympic road races. Only cyclists looking to ride the absolute best of the best are investing at this level, and it's sort of cool that we can get anywhere close. I can't see many Moto GP fans shelling out the $1 to $2.5 million they'd need to spend to ride a bike the same as their idols' – and I imagine most of them would be a damn sight safer on a Honda CBR650.

BMC's €10,000 'Masterpiece'

This winter, BMC quietly launched its 'Masterpiece'. The Swiss brand is offering this frame at an eye-watering €10,000. Each is made to order, handcrafted in Germany, and the purchase is more of an 'experience' than a transaction, including a visit to the HQ for a bike fitting if desired.

Global PR manager Melanie Leveau wouldn't tell us if there was any M40X in the frame, but she did tell us:

"The BMC Masterpiece is a Roadmachine; the only difference is the aesthetics and the way the frame is produced. If you ride a Roadmachine 01 and Roadmachine Masterpiece, the experience is exactly the same. The experience is a visual experience if you like the raw carbon and appreciate the work that is behind this raw carbon. The Masterpiece is made as a one-piece – we have one mould per size, and only four sizes [51 to 58]. It is not a traditional Asian production, and it takes a bit more than a day to produce one. Also, the way the carbon patches are placed in the mould is way more precise vs what is made in the more traditional production. We didn't set any numbers [in terms of sales forecast]; we are expecting a three-digit number – on the low side of that."

Cutting the cost by going direct only

Cutting out the 'middleman' – in this case that being your friendly local bike shop – is one way of cutting the cost, albeit a controversial one as many of us rely on the good old LBS when things go wrong. However, it's the main reason Ribble says it can provide value to customers.

Jamie Burrow, head of product at Ribble, told us: "Exchange rate fluctuations are an ongoing issue particularly with so many contributing factors at play (Brexit, elections, Covid etc) – but the industry is also dealing with various other potentially more significant challenges in the current climate, including significant increases in costs pertaining to shipping and freight combined with major delays at UK ports and longer lead times especially to components. We have also seen general raw material cost inflation throughout the production process from alloy and carbon used in frame and component manufacture to cardboard used in packaging, all of this puts increasing pressure on us and other manufacturers. Furthermore, and very importantly there are increased operational costs involved in keeping production, workforces, staff and customers all safe particular during this pandemic.

"Ribble bikes are only available direct and as such there are no middlemen, with the saving being passed directly onto the customer whilst also ensuring we can offer a unique level of customisation through our Bike Builder and personalisation through our Custom Colour by assembling in the UK. The quality of our product and design is cutting-edge and is aligned with and even ahead of WorldTour bikes. The saving only comes from our direct route to market."

Michelle Arthurs-Brennan the Editor of Cycling Weekly website. An NCTJ qualified traditional journalist by trade, Michelle began her career working for local newspapers. She's worked within the cycling industry since 2012, and joined the Cycling Weekly team in 2017, having previously been Editor at Total Women's Cycling. Prior to welcoming her first daughter in 2022, Michelle raced on the road, track, and in time trials, and still rides as much as she can - albeit a fair proportion indoors, for now.

Michelle is on maternity leave from April 2025 until spring 2026.