'Do cyclists have to have insurance?' - you asked Google and we've got the answer

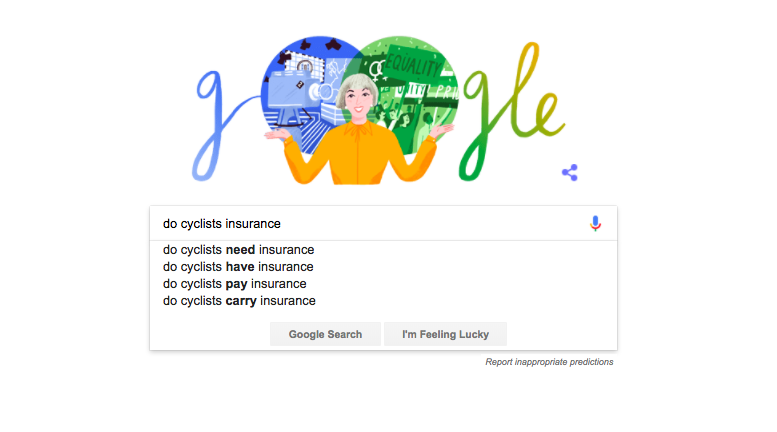

However you start your question, Google has an autocomplete response for cyclists and insurance - but what's the answer?

Start your question 'do cyclists' or 'why do cyclists' - and several of the top Google autocomplete answers revolve around insurance - namely do cyclists pay it and if not, why not?

The presence of these two questions in the ready made search options puts them into the 'most asked' group on the dominant search engine. So what are the answers?

You asked Google, and we’ve got the answer:

- ‘Why do cyclists ride side by side?’

- ‘Why do cyclists ride in the middle of the road?’

- ''Why do cyclists wear lycra?’

- 'Do cyclists have to ride on the road?'

Are cyclists required to have third party liability insurance?

Third party liability insurance is a legal requirement for a driver, and it pays for claims made against them. In the instance that a cyclist is injured or their bike is damaged in a collision caused by the driver, their insurance will pay.

It is not a legal requirement for cyclists to be insured.

There have, in the past, been calls for cyclists to have insurance - as well as number plates - but these have been unsuccessful.

The latest race content, interviews, features, reviews and expert buying guides, direct to your inbox!

Cyclenation, a federation made up of local cycling organisations, explains the reason cyclists do not have to have insurance, stating: "In most collisions involving a cyclist and another road vehicle it is the cyclist who comes off worst. It is therefore up to them to decide whether they should take out insurance, not the state."

What if a cyclist causes an accident and damages a car or injures a person?

Though it's not a legal requirement for cyclists to have any sort of third party insurance, some do. There are several ways in which an injured party could make a claim...

Cyclists may be covered through home insurance

Statistics released by the Department for Transport state that 80 per cent of cyclists also hold a driving license - so are likely to own a car which is insured. However, if a cyclist is involved in an accident whilst riding their bike, it's not the responsibility of their car insurer to pay for any damages.

If an accident takes place, and the liability is with the cyclist, it's sometimes possible for the injured/damaged party to make a claim on a home insurance policy held by the cyclist.

This does depend upon the cyclist's policy - but most home insurance policies cover first party property and third party liability claims. The former covers the individual and their property. The latter covers them for claims made against the home owner or their family members, who reside in the home.

Cyclists can have cover through British Cycling or CyclingUK membership

Aside from claiming through home insurance, many cyclists are also members or organisations like Cycling UK or British Cycling - who will also cover damages if a cyclist is liable.

There are over 67,000 Cycling UK members in the UK - and they pay in the region of £3.75 a month (or £45 a year) for the privilege.

One of the benefits of being a Cycling UK member is that the individual receives £10m third party liability insurance cover to protect them on and off the road.

Sam Jones of Cycling UK told CW: "If you are liable in an accident and you don't have Third Party insurance, and it's not possible to claim on home insurance, then you could have to pay out of your own pocket. So having insurance is a good additional safety net."

Cycling UK's insurance policy also covers collisions between cyclists - so for example if you and a pal happen to collide during a group ride, as long as it's not a race, then you can (in a friendly manner) claim against each other.

It's also possible for people who cycle for a living - for example offering cycle training - to take out additional policies and Jones told us that was something he'd advise.

British Cycling members also receive third party cover up to £10m - provided they have a Race Gold, Race Silver or Ride membership.

Ride members, Race Gold and Race Silver members also receive Legal Support - which means British Cycling will help cyclists who have been injured or suffered damage to property in the event of an incident.

Finally, Race Gold members have Personal Accident insurance too which will help pay for any medical bills.

Cyclists can buy third party cover as part of wider policies

Whilst cyclists are not legally required to purchase insurance, there are policies available.

Popular insurers include Yellow Jersey, Cycle Guard and PedalSure.

Though the majority of policies include Third Party cover, most are largely focused around covering the bike rider, and their property. Perks also include cover if the rider is forced to cancel entry to a race, a holiday or damage to the bicycle when travelling on an aeroplane. Third party liability insurance is usually thrown in as well.

>>> Bicycle insurance: everything you need to know

PedalSure's Phil Cooper told CW: "The benefits [of having Third Party Insurance] are simple, you will be covered in the event that you cause a claimable damage to a third party."

"Those with [third party liability cover] from BC and others, often think they are also covered themselves. PedalSure entered the market to address the shortfall in cover for Personal Accident that covers the cyclist themselves."

"We include cover up to £150k, physio, dental and also loss of earnings. Whilst this level of cover is optional, it provides transparent add ons which help explain the limits of third party insurance."

Should cyclists have Third Party Insurance?

We've established that cyclists don't have to have third party insurance - but they can buy it, or get it through Cycling UK or British Cycling membership.

Should they?

PedalSure's Cooper adds: "If a liability is found against a cyclists, then without adequate insurance, the cyclist themselves would be liable. That exposes anyone cycling on the open road without adequate cover.

"My personal view is that everyone is in a stronger position if Third Party Insurance was compulsory. It would help protect cyclists from monetary effect of claims and also ensure that motorists have an assurance of payment. If the cyclist has poor financial means, then the motorist (or pedestrian) may end up unpaid."

Sam Jones at CyclingUK is less pro the compulsory idea, but does suggest it's a good idea: "[Third Party Insurance] is one of our major offerings to our members. We do support the idea and encourage people to have it.

"But at Cycling UK we don't think it should be compulsory. It would become an additional barrier to entry not to mention next to impossible to administer. Also, there's a low likelihood of a cyclist being in a position to cause a massive amount of damage."

Michelle Arthurs-Brennan the Editor of Cycling Weekly website. An NCTJ qualified traditional journalist by trade, Michelle began her career working for local newspapers. She's worked within the cycling industry since 2012, and joined the Cycling Weekly team in 2017, having previously been Editor at Total Women's Cycling. Prior to welcoming her first daughter in 2022, Michelle raced on the road, track, and in time trials, and still rides as much as she can - albeit a fair proportion indoors, for now.

Michelle is on maternity leave from April 2025 until spring 2026.